Issued by; CARE Super Pty Ltd (Trustee) ABN 91 006 670 060 AFSL 235226 RSE L0000956 CARE Super (Fund) ABN 98 172 275 725

Disclaimer: The information contained in this Annual Report is about CARE Super and is not intended as financial advice. It does not take into account specific needs, so you should look at your own personal position, objectives and requirements before taking any action. Past performance is not a reliable indicator of future performance and you should consider other factors before choosing a fund or changing your investments. For a copy of the CARE Super Trust Deed (the legal document governing superannuation benefits in the fund), Financial Statements for the Trustee and the Fund or the Investment Policy Statements please go to our website. You can also ask for a copy to be sent to you. You should also obtain and read the Product Disclosure Statement before making any investment decision. If you would like to see these documents, please go to caresuper.com.au or call 1300 360 149.

We’re a ‘profit to members’ fund so we only charge fees to cover costs, not to make a profit to pay shareholder dividends.

While we work hard to keep our costs low, we’re driven by providing quality services, relevant choices and strong results – not by being the cheapest - because we know that when it comes to our members’ super it’s the overall benefit that counts.

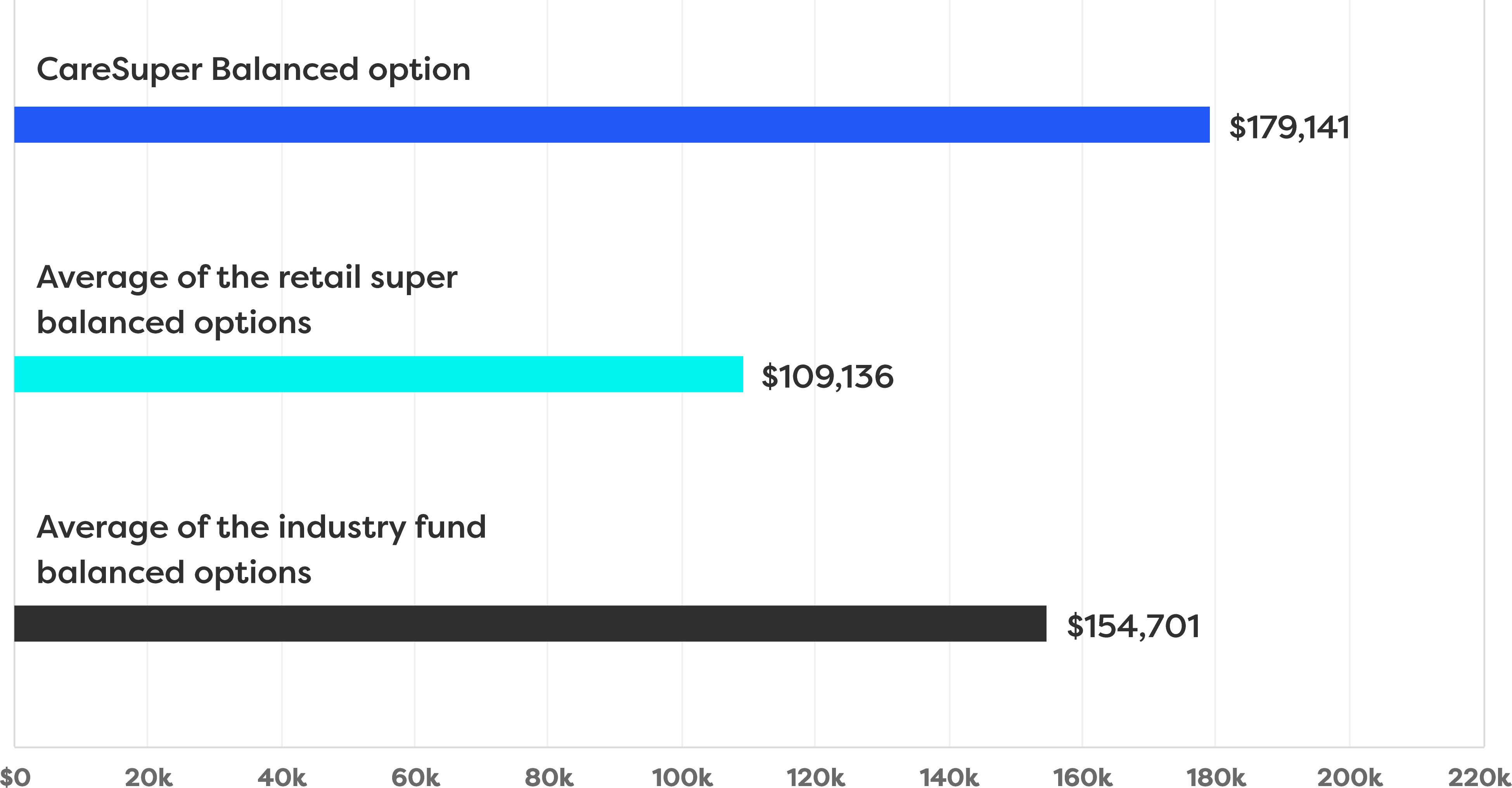

The result? Over 15 years to 30 June 2018, our Balanced option returned over $70,000 more than the average of all surveyed retail funds and outperformed the average of all surveyed industry funds by over $24,000.

Past performance is not a reliable indicator of future performance. Comparisons modelled by SuperRatings as at 30 June 2018, commissioned by CareSuper. Assumes a starting balance of $50,000 and initial salary of $50,000 and considers historical earnings and fees – excluding contributions, entry, exit and adviser fees. Compares the average difference in net benefit performance of CareSuper’s Balanced option and the balanced options of up to 166 funds tracked by SuperRatings, including 45 funds with a 15-year performance history. Outcomes vary between funds. See caresuper.com.au/assumptions for more details about modelling calculations and assumptions. This information is general advice only. You should consider your investment objectives, financial situation and needs and read the product disclosure statement before making an investment decision.